Superb money managers are comparable to the biggest names in the financial industry. The wealthiest investors have amassed enormous wealth from their ventures and, frequently, have aided millions of others in achieving comparable returns. The approaches and ideologies that these investors used in their trading varied greatly. While some developed fresh and creative methods for analyzing their investments, others chose their stocks primarily based on gut feeling.

What comes to mind when you hear the word “billionaire”? You envision someone living in a mansion or operating a high-end sports vehicle. Have you ever wondered, though, how these billionaires made their fortunes? Many of them had a sound investing strategy that allowed them to gradually increase their fortunes rather than just luck into riches.

List Of Top 10 Richest Investors In The World

1. Warren Buffet -$136.5 Billion

A well-known personality in the finance field, Warren Edward Buffet is well-known. He is known as the “Oracle of Omaha” because to his remarkable record of outperforming the market. Buffet’s investment approach is centered on making large investments in great businesses that have a considerable competitive advantage—often referred to as a “moat.” He prudently put his money, even at the age of 14, into pinball machines, which he rented out for a profit. Buffet continued his education in finance by obtaining a master’s degree in economics and a business administration degree. Buffet became a millionaire at the age of thirty, amassing a sizeable fortune. Despite his elderly age, he still serves as CEO of Berkshire Hathaway, where he has the largest ownership share, and has a net worth of around $136.5 billion.

2. Ken Griffin -$37.9 Billion

A very successful hedge fund manager and entrepreneur is Kenneth Griffin. At the age of 19, he made headlines when he shorted the market on Black Monday. At the age of 21, he launched his first fund under Citadel LLC, and it saw impressive returns of over 40% in its first years. Griffin founded Citadel Securities in the early 2000s, and the company prospered greatly following the 2008 financial crisis, adding to his fortune and notoriety. Griffin, who has a net worth of $37.9 billion, is still a respectable investor despite some negative publicity concerning Citadel Securities’ participation in the 2021 GameStop mania. He is well-known in the finance sector thanks to his clever investment methods and steady financial success.

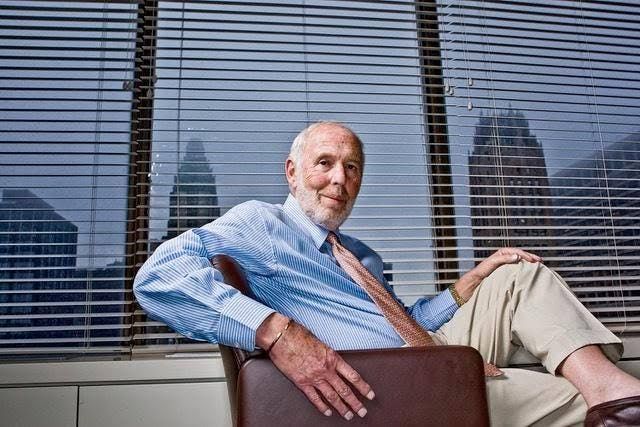

3. Jim Simons -$28.1 Billion

Many people consider Jim Simons, often known as the “Quant King,” to be among the best stock market investors. Being a mathematician of distinction, he understood how statistical data may beat the markets. Using his prowess in mathematics, Simons established the Monemetrics hedge fund in 1978. This company then changed its name to Renaissance Technologies in 1982. Simons skillfully took advantage of market inefficiencies through the use of models and algorithms. Despite having a prosperous career as a code breaker and mathematician, he dabbled with finance and learned the value of statistical data in investing. With a net worth of over $28.1 billion, Simons retired in 2009 and gave up his position as chairman in 2021.

4. Steve Cohen -$19.8 Billion

Among the wealthiest investors in the world, Steve Cohen distinguishes out because he mostly used short-term trading techniques to build his fortune. He started his career on Wall Street as a junior trader after graduating from the University of Pennsylvania’s Wharton School with a degree in economics. Cohen established SAC Capital Advisors in 1992. The company later ran into legal problems related to insider trading and paid a hefty $1.8 billion punishment. Cohen renamed the company Point72 and paid the expenses personally. His $19.8 billion net worth is a result of Point72’s profitable ventures into businesses including Google, Visa, and Western Digital. Even with the scandal, Steve Cohen is still one of the wealthiest investors in the world.

5. Ray Dalio -$15.4 Billion

Renowned economist Ray Dalio, the author of “Principles: Life and Work,” is well-known for his unorthodox approach to management that places a strong emphasis on integrity and openness. Having started investing at an early age, he went on to form Bridgewater Associates in 1973 following his MBA from Harvard Business School. In 2013 Bridgewater rose to the top of the global hedge fund rankings and continue to hold that position. Dalio’s present $15.4 billion net worth is a result of his investments in businesses like Google and Facebook. He recently made known that he was leaving his position as chairman of Bridgewater Associates.

6. Paul Tudor Jones -$8.1 Billion

Paul Tudor Jones II is a prominent person on this list who views himself more as a trader than an investor. He is well-known for his careful preparation and environmentally conscious outlook. Following his economics degree from the University of Virginia in 1976, Jones’s family member introduced him to stock trading. After starting off at the New York Cotton Exchange, he went on to work for E.F. Hutton & Co. as a commodities dealer. In the end, he established Tudor Investment Corporation, which uses a range of investment techniques, such as fundamental stock investing in the US and Europe and worldwide macro trading. Notably, Jones shorted the market on Black Monday and made an astounding 60% profit. Paul Tudor Jones, who has a net worth of $8.1 billion, is still regarded as a very important person in the investing community.

7. Bruce Kovner -$7.7 Billion

As a philanthropist and extremely successful hedge fund manager, Bruce Kovner places a strong priority on risk control in his investing techniques. After missing out on soybean contracts, he learned a vital lesson that made him stress the significance of booking profits at the appropriate moment. In his capacity as chairman of CAM Capital, which he founded in 2012, Kovner oversees his trades, investments, and commercial endeavors. He has amassed an impressive wealth of $7.7 billion by concentrating on commodities and currencies, placing him in the top 10 richest investors in the world.

8. George Soros -$6.7 Billion

Famous investor George Soros is well-known for his trust in his gut and his aptitude at spotting market inefficiencies. When he was able to sort the British Pound in 1992 and make almost $1 billion in profit, he became well-known. Soros started his career in banking before starting his first hedge fund, Double Eagle, in 1969. He was born in Budapest and eventually moved to the UK. During its peak years from 1970 to 2000, the Quantum Fund, which he managed, saw outstanding yearly returns, averaging 30%. In addition, Soros is well known for his charitable contributions, having given away a sizable amount of his wealth—roughly 64%. With a $6.7 billion net worth as of right now, he is still considered a major player in the financial industry.

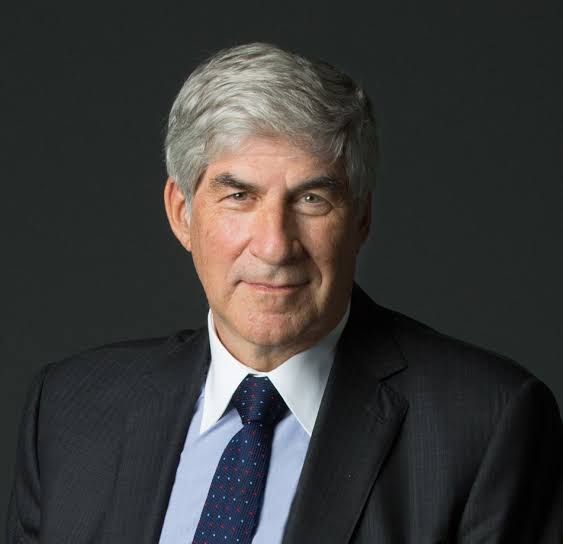

9. Stanley Druckenmiller -$6.2 Billion

Stanley Druckenmiller is well-liked in the investing community despite not being as well-known as George Soros or Warren Buffett. He invests using a top-down strategy, holding both long and short positions in a variety of assets. He was chairman and president of Duquesne Capital when it was established in 1981. With more than $12 billion in assets, he shut down Duquesne Capital in 2010. During his tenure at the Quantum Fund, Druckenmiller worked closely with George Soros and integrated aspects of Soros’ investment theory into his tactics. In addition to substantial stakes in Microsoft, American Airlines, and Delta Airlines, his portfolio also contained investments in gold and cryptocurrency. With a $6.2 billion net worth at the moment, Druckenmiller has had a prosperous career in the financial sector.

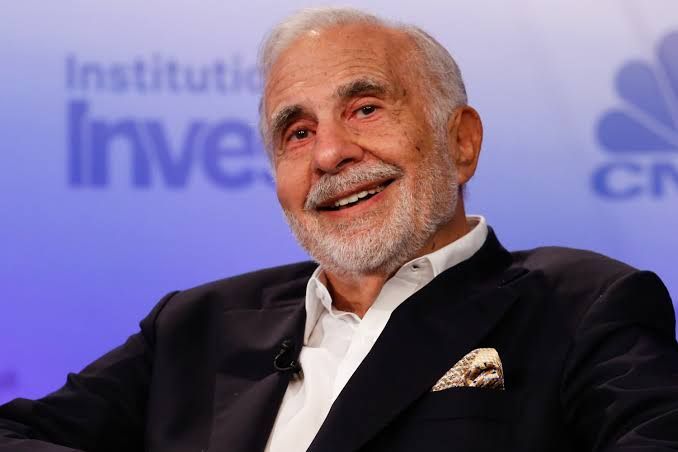

10. Carl Icahn -$5.4 Billion

Renowned activist investor Carl Icahn is well-known for his approach of buying sizable shares, and occasionally all, in businesses in order to resolve fundamental problems or sell assets for a profit. His hostile acquisition of Trans World Airlines, in which he sold the airline’s London services and made an incredible $469 million, made him famous. In order to concentrate on operating Icahn Enterprises, where he still uses his activist investment strategy, Icahn left the hedge fund business in 2011. Icahn, who is well-known for being a successful individual in his industry, has amassed his wealth since the 1970s by purchasing and turning around failing companies. Even if Icahn Enterprises was negatively impacted by a Hindenburg Research report, his estimated net worth is still $5.4 billion.

7.